A Scotiabank subsidiary has sold all of its remaining shares in an Israeli arms company, according to reports on recent regulatory filings.

The news comes after more than three years of public campaigns calling on Scotiabank to divest from Elbit Systems, a company that plays a key role in arming the Israeli military as it commits genocide in Gaza.

As reported by The Intercept in 2023, Scotiabank’s 1832 Asset Management held an estimated $500 million stake in Elbit Systems, making the Canadian bank the largest foreign shareholder in the Israeli arms company at the time.

Activists promptly organized pressure campaigns calling on Scotiabank to cut ties with Elbit Systems. This ramped up after Israel launched its genocidal war on Gaza in October 2023.

Over the course of 2024, 1832 Asset Management significantly reduced its stake in Elbit Systems. The Scotiabank subsidiary did slightly increase its stake last year, before dissolving all remaining shares in the most recent reporting period.

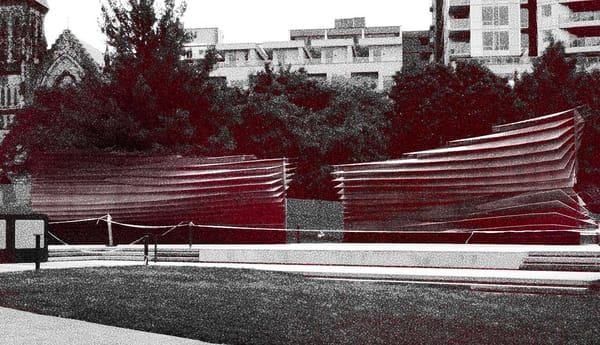

The campaign calling on Scotiabank to cut ties with Elbit Systems included a protest at the prestigious Giller Prize gala in November 2023, an event that was sponsored by Scotiabank at the time. As reported by The Breach, two activists took to the stage and unfurled a banner reading “Scotiabank Funds Genocide.”

Later in the evening, another activist mounted the stage shouting “Scotiabank is complicit in the genocide of the Palestinian people!” All three were charged with mischief and use of a forged document.

The protest galvanized a coalition of hundreds of writers and artists, who came together to form No Arms In The Arts. The charges against the protesters were ultimately dropped, and the Giller Prize eventually cut ties with Scotiabank in February 2025, ending a 20-year relationship.

Other actions included flash protests, sit-ins at Scotiabank branches and national days of action.

The bank has previously denied that public pressure influenced the decisions made by its portfolio managers. Scotiabank did not respond to an emailed request for comment from The Maple for this story.

Michael DeForge, a graphic novelist involved in No Arms In The Arts, told The Maple that he believes Scotiabank’s investment in Elbit Systems became an albatross around the bank’s neck that it could not ignore.

“They were so over indexed and they were so over exposed in this thing that the majority of Canadians don’t support,” said DeForge.

“Even if we aren’t privy to a lot of the internal machinery that makes some of these decisions, I do think it’s safe to say that Elbit became less and less sustainable for them to hold on to in this way.”

In a statement, No Arms In The Arts highlighted past comments from portfolio manager David Fingold, who said in a 2019 interview: “Israel accounts for a larger share of our investment portfolio than its proportion in the indices.”

DeForge said the protest at the Giller Prize gala was a key moment in drawing attention to Scotiabank’s stake in Elbit Systems.

“A few of us who had experience working in divestment campaigns in the past got together and tried to actually map out what a sustained campaign targeting Scotiabank’s art sponsorships would look like,” he explained.

“We knew that Scotiabank at the time relied quite a lot on the good publicity of its art sponsorships. It was kind of known as the ‘arts bank.’”

No Arms In The Arts also drew attention to Scotiabank’s then-sponsorships of Hot Docs and the Contact Photography Festival.

In 2024, eligible authors, past winners and judges withdrew from the Giller Prize, DeForge said. This subsequently expanded into a fully fledged boycott campaign.

Although he wasn’t involved in coordinating the national days of action, DeForge said these campaigns gave concerned citizens across the country tools to make their objections heard in their communities.

The actions ranged from information pickets held outside of Scotiabank branches in small towns, to a sit-in at the bank’s national headquarters in Toronto.

No Arms In The Arts is now focusing its attention on family foundations that it says have links to companies that have direct stakes in Israel’s genocide in Gaza and illegal settlements, DeForge said.

Karen Rodman, a director with Just Peace Advocates (JPA), noted that data from 2025 showed the “big five” Canadian banks – Royal Bank of Canada, Toronto Dominion, Bank of Montreal, Canadian Imperial Bank of Commerce and Scotiabank – all held investments in companies operating in occupied Palestinian territory.

“It’s not like Scotiabank doesn’t have other divestment work that they need to do as well,” Rodman told The Maple. In a 2025 report, JPA alleged that Scotiabank held $18.3 billion of first quarter investments in “complicit companies.”

In a statement, No Arms In The Arts said: “The campaigns against Scotiabank set a critical precedent for what is deemed a permissible investment by supposedly ‘neutral’ investors.”

“We must not relent, and instead stay focused on dismantling financial and political support for Israel.”