Subsidizing The Occupation is a project created by The Maple’s opinion editor, Davide Mastracci, documenting how a vast network of Canadian charities has subsidized the Israeli occupation of Palestine.

This article offers analysis of the project’s findings. Please ensure you’ve gone through the project’s website in its entirety before reading this analysis.

As a refresher: “top-level charities” refers to charities that, according to the Canada Revenue Agency (CRA), contributed to at least one of the following aspects of the Israeli occupation of Palestine: the illegal settlements and the military; “second-level charities” refers to charities that donated to the top-level ones during the calendar years of the audit period upon which the CRA revoked its charitable status.

Donation Breakdown

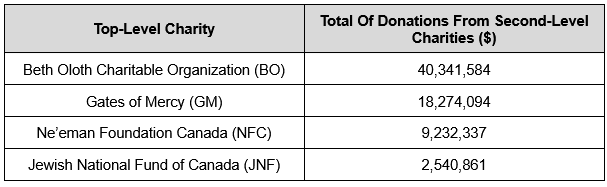

I found that 434 second-level charities donated at least $1 to at least one of the four top-level charities in the project during the calendar years of the relevant CRA audit period. Together, these charities donated more than $70 million to these top-level charities during all of the calendar years of the audit periods combined (a total of nine years).

The donation total was split between the four top-level charities as follows:

(It is possible that some of the donations included in the totals for BO and GM may fall outside of the audit periods by up to a few months because the CRA was not able to provide specific dates for donations.)

These totals were somewhat surprising, given that the JNF is well-known and has attracted considerable media attention over the years and yet received just a fraction of the donations that BO did.

Around 40.1 per cent of the 434 second-level charities donated to just one of the four top-level charities. Meanwhile, 28.2 per cent donated to two, 7.8 per cent donated to three and 4.1 per cent donated to all four. The fact that about 60 per cent of second-level charities donated to more than one top-level charity is significant, according to a 2022 article “International Cash Conduits and Real Estate Empires: A Case Study in Canadian Philanthropic Crime” in the Journal of White Collar and Corporate Crime by Miles Howe and Paul Sylvestre.

The article focused on two of the four top-level charities plus one other. The authors wrote, “Tracking three burner charities (Gates of Mercy, Beth Oloth, and the Jewish Heritage Foundation) across two decades, we outline a relationship of activity and dormancy, wherein once an active burner charity has its charitable status revoked a subsequent burner charity is activated in its place. Following activation, large volumes of donations are re-directed to the newly active charity by a large network of public and private anchor foundations [a term the authors use to refer to charities that have donated to GM, BO and the Jewish Heritage Foundation], such that funds continue to move overseas uninterrupted.”

Around 31 per cent of our second-level charities donated to both BO and GM.

With this in mind, the authors argue that what are referred to in this project as the second-level charities donating to more than one of the charities they focus on “represents, at best, a kind of informed indifference regarding the conduit activities of burner charities. At worst, anchor foundations are knowingly complicit and utilize burner charities as a tax evasion scheme to shift a portion of their family legacy to Israel and the United States, where, due to the lack of direction and control of the agents, the money effectively disappears into a black box.”

The authors add, “Research into charities clearly demonstrates that philanthropic law-breaking results in a loss of donor trust in offending organizations, which in turn translates into a loss of donor revenue [...] This is clearly not the case with burner charities, where despite clear commonalities in terms of governance and a pattern of serial regulatory violation, donor support increased across each subsequent charity. We argue that this is because the purpose of burner charities is to allow private and public foundations to fund foreign activities that contravene Canadian law while remaining shielded from the legal consequences of their actions.”

As such, Sylvestre and Howe argue that at least some of these anchor/second-level charities may have been aware of what they allege was going on, and making donations accordingly.

Charity Breakdown

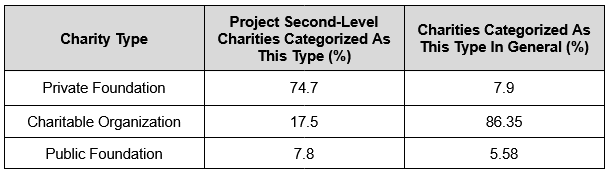

The CRA has established three general categories of charities: public foundations, private foundations and charitable organizations. It defines charitable organizations as charities that primarily carry out their own charitable activities, public foundations as charities that give more than 50 per cent of their annual income to other charities, and private foundations as charities that can do either in any amount but tend to receive their funding from donors not at arm’s length (i.e., families funding and running a charity).

I used this system to categorize all of the charities. Here is the breakdown of the 434 charities by type, as well as a comparison to the charity breakdown in general (i.e., all charities in Canada) as of 2023.

The project’s breakdown was significantly different from the general breakdown of charities in Canada. The most notable difference is the 66.8 percentage point disparity in the makeup of private foundations, which demonstrates that the charities involved in this project are far likelier to be started and funded by private families than Canadian charities in general.

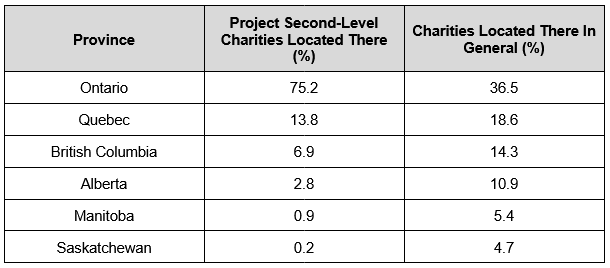

A geographic breakdown of the second-level charities by their mailing addresses revealed that Ontario was drastically over-represented when comparing the percentage of second-level charities within it (75.2 per cent) to the percentage of charities based in the province in general (36.5 per cent) as of 2023. Every other province, meanwhile, was underrepresented to some extent, sometimes drastically, or did not appear at all.

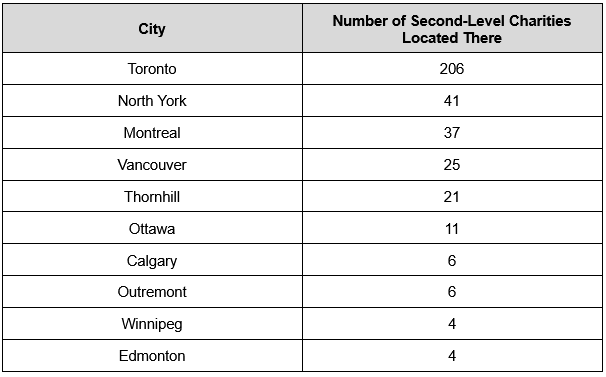

There were also some anomalies at a city level, given the charity-to-population ratio.

In addition, I found that there was a significant number of charities with religious purposes among the second-level charities. They were composed exclusively of Jewish and Christian groups.

For example, 26 synagogues in Canada were represented among the second-level charities, making up anywhere between 9 to 15 per cent of synagogues in the country as a whole depending on which directory of them is used. Meanwhile, five churches (including two messianic churches) were found among the second-level charities. These religious institutions also gave widely varying amounts, with about $319,000 coming directly from synagogues and $5,500 from churches. When expanded to include religious charities in general, the amounts rose to $661,197 and $8,331 from Jewish and Christian ones, respectively.

There was also a wide-range of Jewish community foundations among second-level charities, namely Jewish federations and foundations associated with particular cities or regions.

Finally, all seven of the schools included among second-level charities were Jewish ones, ranging from elementary schools to universities. Together, these Jewish schools cumulatively donated about $301,149 to top-level charities.

Major Donors

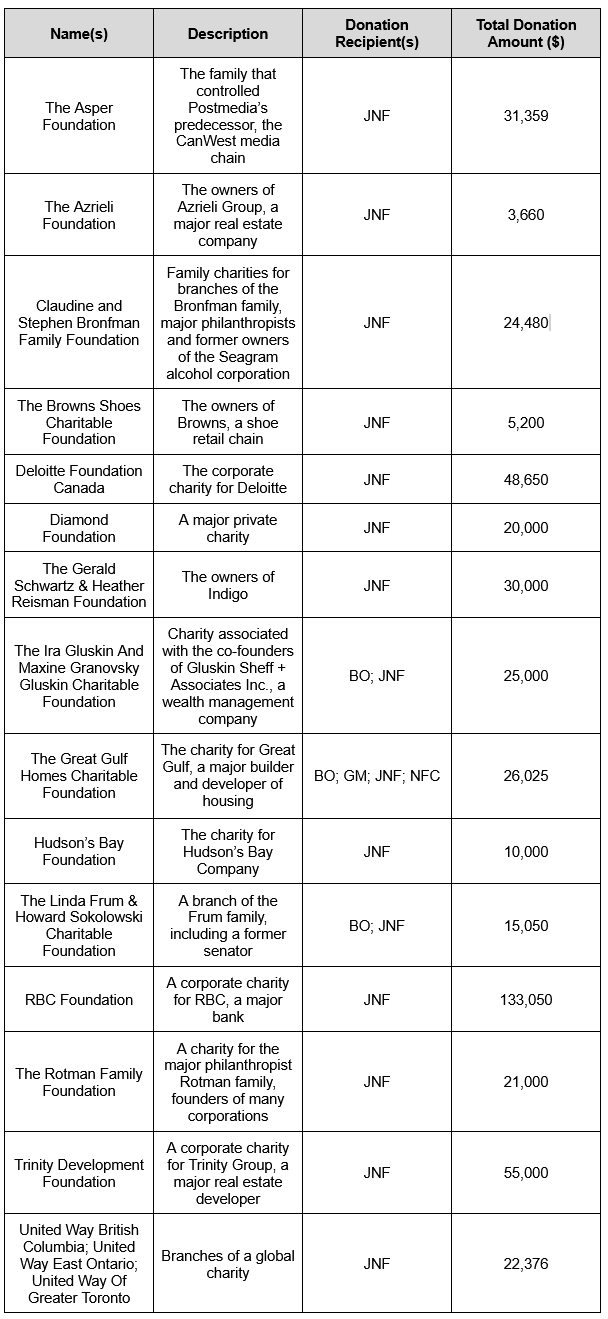

A search through the list of second-level charities turned up an assortment of major corporations, prominent families, developers and more. Here are some of them.

I was unable to search all of the second-level charities due to time constraints, so it’s likely that some notable charities haven’t been included in this table. If you believe any are missing, you can send us a suggestion.

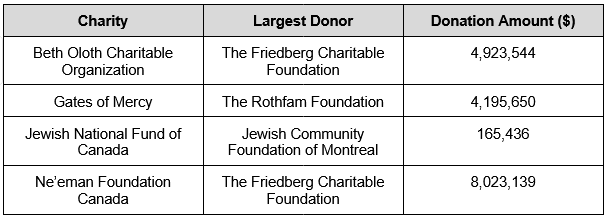

No minimum donation amount was implemented for inclusion in the project, as I believe any donation the second-level charities found worth making is worth reporting and in the public interest. The amount of donations from each second-level charity varied widely. Here is the largest donor to each of the four top-level charities:

The Friedberg Charitable Foundation is a private foundation associated with the Friedberg Mercantile Group Ltd., which “provides a wide range of financial and investment services to retail and institutional clients.”

The Rothfam Foundation is a private foundation that provides grants to “Orthodox Jewish, educational, and social welfare organizations to enable these organizations to sustain and fulfill their charitable activities.”

The Jewish Community Foundation Of Montreal is a public foundation that manages assets from donors and invests them.

Why Does It Matter?

With these findings presented, it’s worth expanding on why this information should matter to Canadians.

First, Canadians should know that money sent from their country has been used for purposes that the CRA found violated Canadian government policy, Canadian law and/or international law. I found that second-level charities contributed at least $70 million to the four top-level charities during all of the relevant audit periods combined (a total of nine years). Based on CRA findings, at least some of this money helped enable: the murder of Palestinians by supporting the Israeli army and the theft of Palestinian land by assisting Israeli settlements.

Some Canadians claim no one in Canada, other than perhaps the Canadian government, is responsible or can be blamed for the actions of the Israeli state. This is true in a sense, as Canadians don’t have control over the Israeli government. However, materially supporting Israel’s endeavours does create some level of complicity in its actions. As such, Canadians deserve to know more about charities in Canada that sent money to those that the CRA has found to have done so, which should promote more critical thought about how Canada is complicit in Israel’s occupation of Palestine.

Second, Canadians should also be aware that they effectively subsidized donations these top-level and second-level charities made, and in doing so, enabled the transfer of money that could have been used for beneficial purposes within Canada to Israel.

Donors to registered charities in Canada enjoy tax breaks from their donations. This means money that would otherwise go to the Canadian government in the forms of tax payments — which could then be spent on social services to improve the lives of Canadians — instead returns to charitable donors.

The exact amount of tax breaks given on the donations included in this project is difficult to calculate, but The Globe and Mail has outlined the general guidelines as follows: “At the federal level your non-refundable tax credit will be 15 per cent of the first $200 of donations and 29 per cent of your additional donations. All provinces have similar credits, ranging from four per cent to 20 per cent. The maximum donation credit you can claim is 75 per cent of your net income for the year.” This means a considerable amount of money has been refunded to donors in the form of tax credits.

In addition, charity law expert Mark Blumberg told the Canadian Jewish News, “There’s a lot of wealthy people getting 80 or 90 cents on the dollar when they donate. What that means is their money is going to Israel, for very good stuff in Israel, but it’s only 10 cents their money, 90 per cent federal and provincial money.”

In a typical case, one could argue that the charitable donations being made offset the money taxpayers are effectively returning to donors because they provide a worthwhile contribution to the public good. In the cases this project examines, however, the donations from second-level charities went to top-level charities that, based on CRA findings, subsidized Israeli theft and murder.

As Howe and Sylvestre note, “Offshoring funds subject to generous tax breaks to non-qualified donees amounts to, at best, the Canadian public subsidizing social services in other states. More importantly, when a charity does not maintain adequate direction and control over their funds, the Canadian public may become unwittingly complicit in subsidizing criminal activity and mass social harms.”

Based on the CRA findings, some of the activity of these charities, therefore, harmed Palestinians and took public funds from Canadians that could have improved their lives all the while making them complicit in Israel’s occupation of Palestine.