Written by Alex Cosh

As The Maple reported last week, recent data from Statistics Canada showed that in 2020, one-in-five houses and condos were used as investment properties in British Columbia, Manitoba, Ontario, New Brunswick and Nova Scotia.

In Ontario, 41.9 percent of condos are investment properties, the highest share of any province. Stat Can also cited a report that found rising levels of property owned as investment assets have contributed to higher housing costs in the United States.

What do our readers think of this issue, and what are some solutions to the housing crisis? Here's what you told us (some responses have been lightly edited for length and clarity).

Marie in Nova Scotia said large real estate investors are picking the bones of struggling Canadians who are left with few housing options amid this country's tight market. She explained:

"Even my landlord who has 50 properties is looking to unload onto another, larger investor. What will happen to me then? Never mind the thousands of students we brought to this island only to make them homeless! It is shameful!"

Marie said existing buildings should be rapidly converted into affordable housing units.

"If a building is rundown by lack of use, eminent domain should be put into practice, to have the buildings retained by the municipalities. They are left just rotting there, useless. That would take care of the eyesore buildings, as well as provide affordable housing and employment opportunities for communities while being converted."

Alain pointed out that the problem of investors eating up housing supply is not only limited to condos. As a result of rising costs and the financialization of housing, homeownership is out of reach for many Canadians.

"A portion of the population ... either will never be able to afford to buy a home or doesn’t want to own one. These life-long renters are also caught in the spiral of forever increasing prices for rent. One wonders where the low-paid workers that occupy jobs in downtown areas of cities, in retail sales, including grocery stores, in restaurants and other businesses, will live in the near future."

Alain also noted that the idea that real estate investors will voluntarily help solve the housing crisis is a "myth."

"The principal, if not only, goal of investors and promoters is to make as much money as possible, as quickly as possible, and preoccupation for a social issue appears to be totally irrelevant to them."

Debbie in Ontario said she'd like to see prospective non-investor homebuyers be given priority for housing purchases over investors, but acknowledged that it is unlikely that an effective system to that end could be put in place.

She added:

"(It) took two years for my daughter to buy a house and as parents we had to help, and we've spent two months of labour fixing it up. Meanwhile, our two investor neighbours (three adults in total) have almost 10 homes between them and wouldn't give her a deal, (and) gouged others by over $150,000 to make the big profit."

Jim, also in Ontario, said he is most concerned about investors buying up detached, semi-detached and row housing, and hopes there is some way the federal government can limit the amount of supply that such investors can accumulate.

Carlie, meanwhile, said she has no faith that either the federal or provincial governments will take meaningful action, adding that Conservative Party Leader Pierre Poilievre uses right-wing "buzzwords" instead of proposing effective housing solutions. Carlie explained:

"How on earth are young people supposed to afford to buy a house or even rent anything? It's deplorable. I'm a senior and if something were to happen health-wise, where would I go? I own my own house but would be unable to afford rent as it's more than a mortgage payment."

Janet in Nova Scotia said the roots of the problem are traceable to the federal government's cancellation of spending on public housing programs in the 1993 budget. She added:

"I have no idea how any politician can face their constituents when their decisions over these 40 years have forced Canadians to live on the street and others who can’t find a decent place to live."

Cathy in Ontario asked: "Who are the investors of condos and other housing? What is the breakdown between ordinary citizens who may own one or two houses and companies who own many more?"

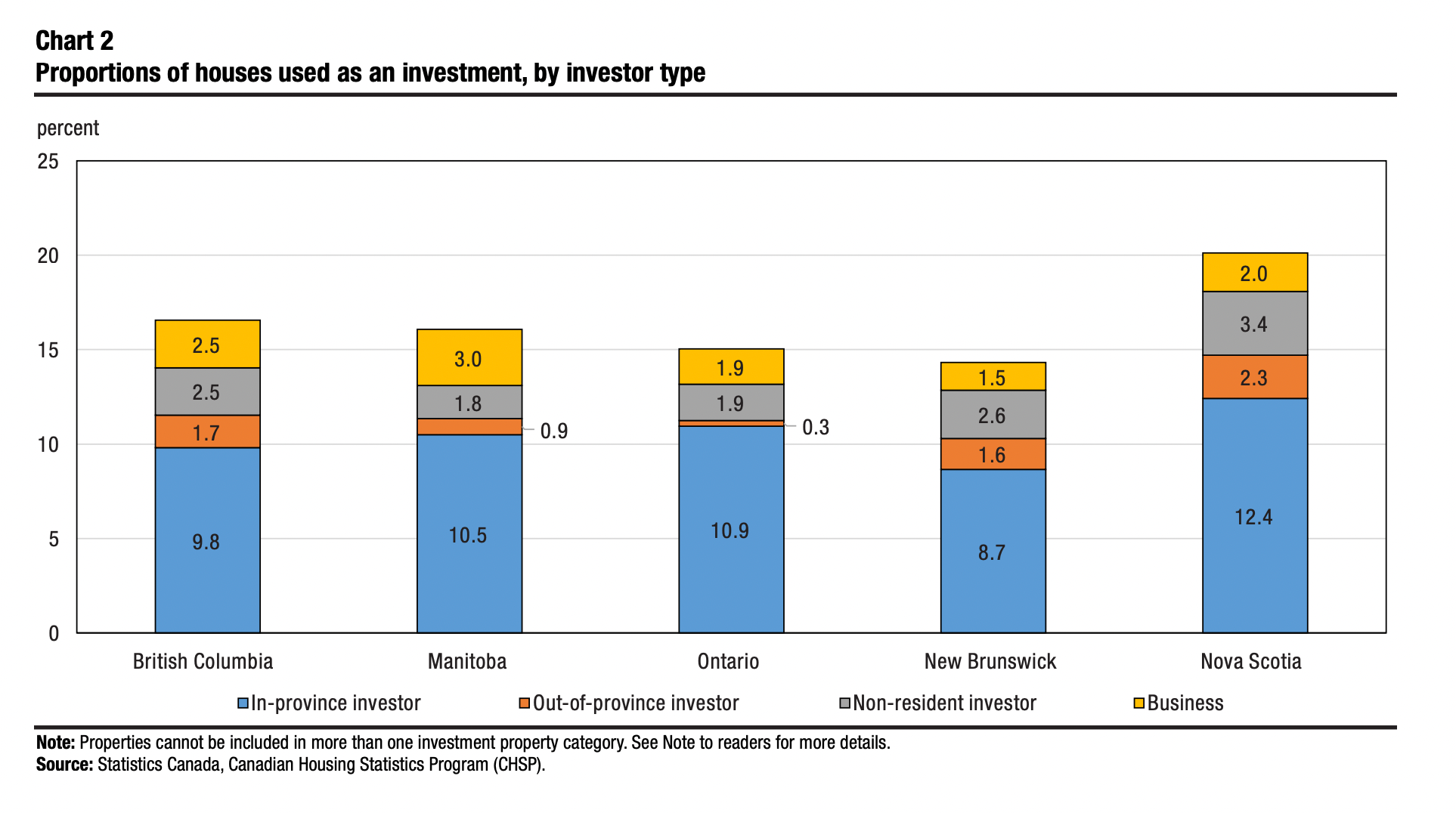

Great questions! Here's what Stat Can's data tells us: The breakdown of investor types varies from province to province.

As you can see from the above chart, the largest share of investors were individuals residing in the same province as where the property was located. The province with the largest proportion of businesses as property investors (three percent) was Manitoba, and the province with the largest share of "non-resident" investors (i.e., those who do not live in Canada) was Nova Scotia.

Speaking of absentee owners... Angie, who sits on the board of directors of her condo community, told us that the majority of units in her community are now owned by corporations. This creates problems for getting quorum for strata meetings.

Angie explained:

"Renters are not allowed to participate in meetings or discussions, irregardless of how long they have lived in their community. It is difficult to foster relationships within our community and to maintain the common areas when the residents are not allowed to be involved and the unit owners are not engaged with the community."

She added:

"I think the government should support local ownership versus foreign ownership. I think a limit on rental price increases would make a huge difference in a world trying desperately to catch up to pre-pandemic times."

Go deeper

Here are a few stories from our archive that expand on today's story

Wealthiest Property Owners Control One-Quarter of Residential Real Estate Value

“If you don't change the regulations around housing, if you don't go into taxation rules and all the kinds of structures of the housing market, you won't solve the problem."

Government Spending on Non-Market Housing Could Pay for Itself, Economist Says

An economist argues that B.C. could massively increase spending on below-market rental housing and that such an investment could “literally pay for itself.”

Top Maple story this week

Voices of Support for Elghawaby Grow After Calls for Her Resignation

From The Maple

On Jan. 26, Prime Minister Justin Trudeau announced the appointment of Amira Elghawaby, a journalist and human rights activist, as Canada’s first Special Representative on Combatting Islamophobia.

However, following the announcement, the Quebec government and other politicians called for Elghawaby’s resignation over a 2019 article she co-authored with Canada Anti-Hate Network chair Bernie Farber that criticized Quebec’s Bill 21, which bans the wearing of religious symbols for some public sector workers.

Catch up on our latest stories

- Experts, Jewish Leaders Voice Concerns Over Omissions in Ukrainian History Poster.

- Forty-Two Percent of Ontario Condos Are Used As Investment Properties.

- Interview: Why Privatization Won't Solve The Public Health System Crisis.