On October 3, the International Consortium of Investigative Journalists (ICIJ), in partnership with the Guardian, the Washington Post, BBC Panorama, Le Monde and more than 100 other publications, leaked what they are calling “the Pandora Papers.” The leak is the latest in a series of document dumps exposing the world of wealthy elites who utilize a “hidden offshore economy” to dodge taxes, conceal assets and shelter wealth.

The Pandora Papers consist of more than 11.9 million documents, ranging from emails to compliance reports, from 14 offshore entities, such as law firms and wealth management companies. The more than 600 journalists involved in the investigation have sifted through these millions of documents and catalogued a labyrinthine system of wealth hoarding and regulatory evasion.

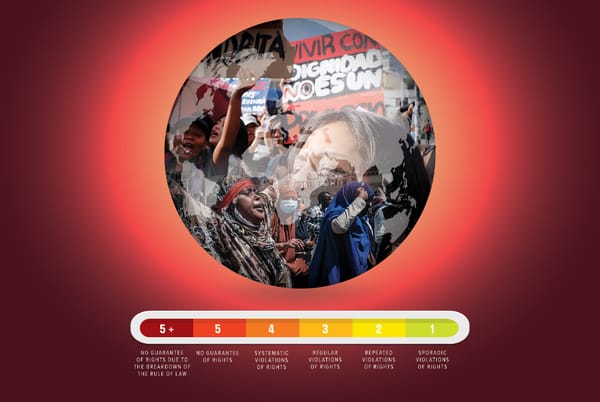

The offshore economy uncovered in the documents shows how the world’s wealthiest skirt the rules to which everyone else is subject, in some cases paying little to no tax in any political jurisdiction.

Much of what the Pandora Papers reveal is perfectly legal, if morally repulsive. Jurisdictions around the world have purposefully crafted their tax and regulatory systems to operate as tax shelters for the uber-rich. However, it is this very regulatory looseness which also attracts money launderers and fraudsters of all stripes, quickly blurring the line between the legal and illegal in an already shady global “industry.”

As the Washington Post explains, they and the other Pandora Papers partners have reviewed the documents over several months and have given persons and companies identified therein the chance to respond and comment. The authenticity of the leaked documents, they maintain, are not in question.

Documents reveal that opaque offshore financial structures and trusts are used by the wealthy to hide trillions of dollars in tax havens, such as Panama, the United Arab Emirates, Monaco, Switzerland and the Cayman Islands. However, it also appears that subnational jurisdictions, such as some U.S. states, are getting in on the action. South Dakota, for example, is revealed to have allowed “trust companies” to permit global elites to shelter money and assets from tax.

Among the business leaders and celebrities implicated, the documents also identify 35 world leaders and more than 300 other public officials acting in various roles for governments around the world.

Although the news so far has highlighted the corruption of leaders in the Global South, such as King Abdullah II of Jordan, president Ilham Aliyev of Azerbaijan and Kenyan president Uhuru Kenyatta, plenty of names from the wealthy Global North appear. For example, former British Prime Minister Tony Blair and his wife are revealed to have bought an expensive office space in Marylebone by acquiring a holding company in the British Virgin Islands, a loophole which saved them from having to pay any property taxes.

The documents also show hundreds of offshore accounts and companies set up for Canadian citizens, including Formula 1 race driver Jacques Villeneuve and figure skater Elvis Stojko. No matter where your wealth came from, there’s interest in sheltering it from taxes, apparently.

This is the latest ICIJ leak project targeting the ultra-wealthy, following the Panama Papers in 2016 and the Paradise Papers a year later. The Panama Papers, in particular, revealed the shady dealings of world leaders and sparked protests around the world, as well as calls from Western politicians to ramp up tax collection and enforcement efforts.

The revelations in the Pandora Papers go well beyond what is referred to as “regulatory capture,” i.e. when people from the very industry under scrutiny are the ones tasked with policing it. Offshore tax avoidance and the opaque world of elite finance and wealth management were designed to benefit those in power.

The audacity and pretension of the wealthy exposed in the Pandora Papers and previous leaks is maddening enough. However, what is most egregious is the fact that by essentially wasting vast sums of wealth on socially useless, luxury private consumption, the ultra-rich are literally robbing the rest of us of a future. That this leak is coming on the heels of a deadly pandemic that necessitated huge amounts of public spending is especially important. Governments around the world will be looking for ways to reimpose austerity and rein in public spending as soon as possible to calm the nerves of the financial elite.

However, politicians looking to assuage angry voting publics will also need to appear as though they are serious about cracking down on this obscene level of wealth concentration and tax evasion. Some of them of course will be embarrassed to see their own names or those of their close friends and families among the outed and guilty. We’ve heard this story before.

Although those of us on the left obviously support bringing wealthy tax cheats and financial criminals to justice, we should also be clear that the Pandora Papers reveal that there is no shortage of wealth in the world with which to address the environmental, social and economic crises we collectively face. We should countenance no public leader who claims that the broad public needs to tighten its belt to pay for the relief necessitated by the COVID-19 pandemic.

Moreover, calls to tax the wealth catalogued in the Pandora, Panama and Paradise papers, in a sense, have the order of priorities backwards. The economy is more than capable of producing all the things we need to address climate change, solve crises in health care and education, and reduce inequality, all while providing well-paid and meaningful work to everyone who wants it.

The issue is that productive capacity is illogically utilized to build luxury items geared to satisfying the desires of the wealthy. You can think of it as demand creating its own supply. If small percentages of the population are the ones with huge amounts of purchasing power, economic sectors crop up to sell them things — or services are created to “manage” their wealth. Much of this production — think luxury yachts and elite vacation resorts — is socially useless to the vast majority of humanity. We need to redirect that productive capacity — the investment, the infrastructure and the labour — to meet the social needs of the vast majority.

Governments can use the power of public borrowing and economic planning to accomplish this right now. There’s no need to wait until we’ve got Jeff Bezos’ or David Thomson’s billions in our hands. When politicians inform us that “we” have to repay these public debts, we can tell them the Pandora Papers offer an alternative payment plan.