Do you live in Canada? Have you been impacted by pro-landlord policies, especially throughout this pandemic? Are you curious to know if your provincial government representative is a landlord or invested in real estate in some way?

If so, you’re in the right place, as The Maple has created a database of provincial representatives invested in real estate.

Provincial representatives in most provinces are required to complete public disclosure reports that contain, in part, property they own, sources of income and investments. These reports tell us if our elected representatives, and/or their spouses/common-law partners/dependents, are landlords/invested in real estate. The provincial governments in question make these public disclosures available on their websites. (The territories as well as Newfoundland and Labrador and Manitoba either do not collect this data or don’t make it accessible online.)

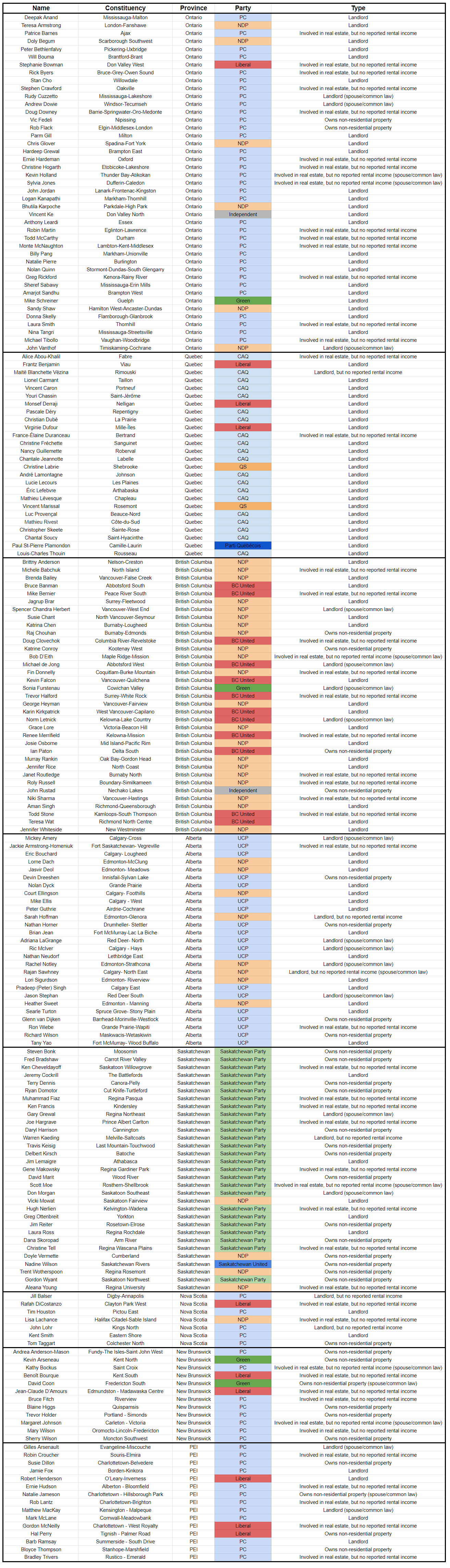

This data is based on the most recent disclosures these representatives made as of Sept. 15, 2023. We have gone through these disclosures and identified which political representatives, and/or their spouses/common-law partners/dependents, fit into one or more of the following categories: 1) disclose residential rental property that they earn income from; 2) disclose residential rental property without disclosing any income; 3) disclose non-residential property (vacant lots, farmland, etc.); 4) disclose some sort of other involvement in real estate (for example as a real estate agent, or with investments in real estate investment trusts). Personal residential and recreational properties are not included.

These provincial representatives, along with their constituency, province and political affiliation, have been listed in the chart below. Each of these representatives are also categorized based upon which of the four options above they best fit into. Some representatives fit into multiple categories, and in that case they are listed according to the earliest category option as noted above. For example, someone that owns rental property and earns income from it, but also has invested in REITs, would be listed as category one in the chart.

We have taken items in the disclosure noted as having applied solely to the period prior to the disclosure into account when determining a representative’s eligibility and categorization. For example, a representative whose disclosure notes that they earned rental income in the prior 12 months would be included in our database and categorized as a landlord. Items no longer on disclosure forms, however, aren’t included in consideration.

You can open the chart below in a new tab to view it in its full size.

After the chart, we’ve provided data analysis looking at breakdowns of representatives included by party and province. Following that, we’ve included a searchable list including each qualified representative by province, the relevant details from their disclosure and a link to their disclosure (as well as important disclaimers for some of the provinces). As previously mentioned, this data is based on the most recent disclosures these representatives made as of Sept. 15, 2023. A representative’s situation may change after that point.

This is the second time we’ve conducted and published this sort of research about provincial representatives. The first was published in March 2021. This edition was updated to reflect elections that have occurred since then, and expanded based upon feedback we received (for example, including a searchable list of representatives with the sources linked and broadening the criteria for being included in the list). This version also includes a new searchable database we’ve created on a mini website to help make navigating it all easier. If you’re interested in seeing this data for MPs, please do check out the article and database we published with that information in June 2023.

When sharing any images or data from this article, please do link back to it and/or the searchable database and give credit to Davide Mastracci at The Maple. In addition, please do consider becoming a Maple member so we can continue putting out this sort of valuable resource, as it’s time intensive and no one else in Canada is doing it. We are now formally pledging to update this data on an annual basis, as well as to keep the mini website alive. But we need your support to make this possible.

With that out of the way, here’s the first table, and then the rest of the data.

The table listing every included provincial representative is below. For a closer look at the members included in each province, see here: Ontario, Quebec, British Columbia, Alberta, Saskatchewan, Nova Scotia, New Brunswick, Prince Edward Island.

Ontario

- Details: Ontario makes public disclosures for MPPs easily accessible through an online tool, although it’s not possible to link to a specific disclosure. The vast majority of the disclosures were filed in 2022.

- Notes: The Ontario legislature had two vacancies at the time this data was captured. As a result, the number of total MPP disclosures reviewed was 122 instead of 124.

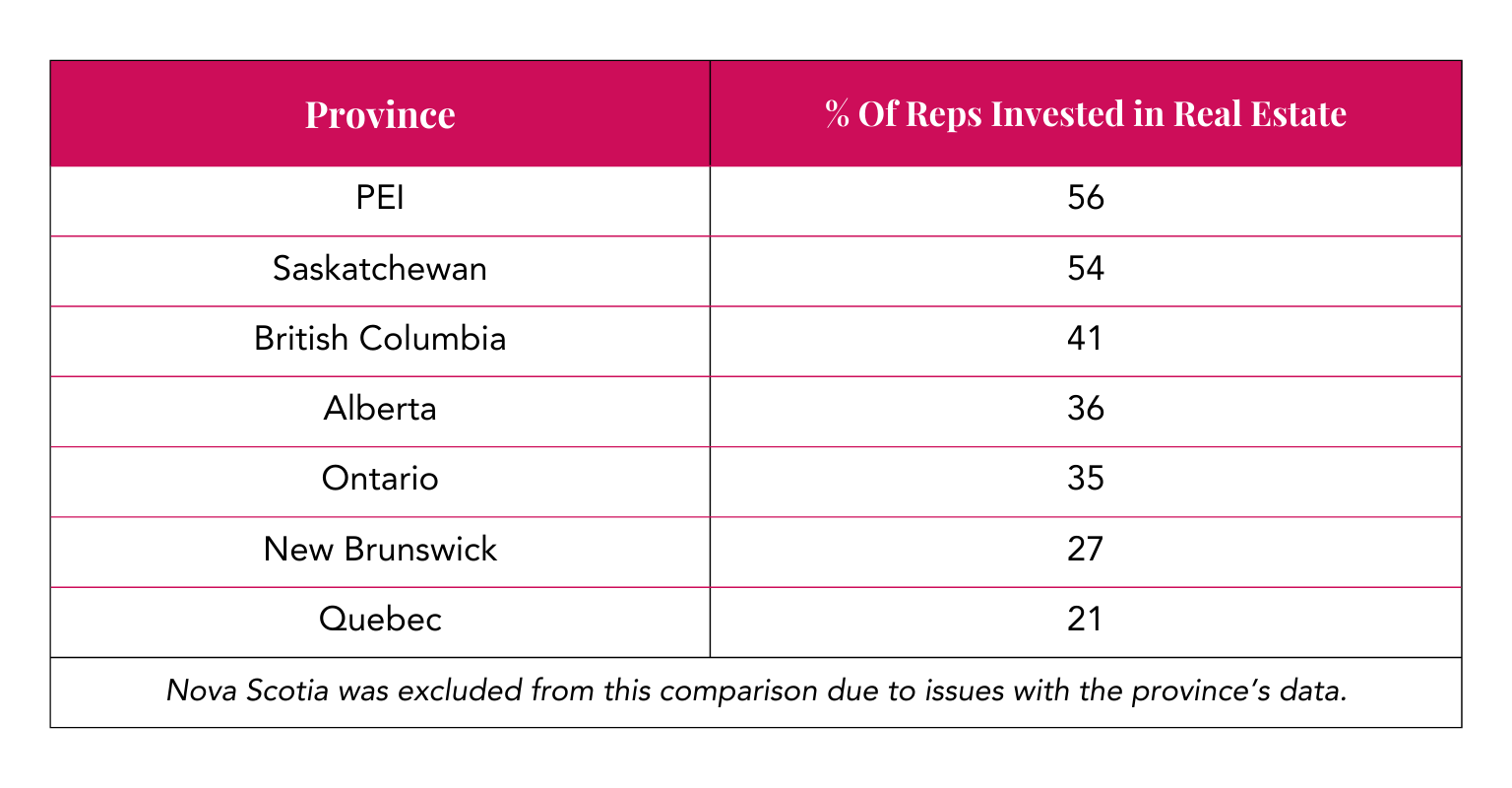

- Total MPPs: 43/122 = 35%

- Relative to per cent of MPs in Ontario invested in real estate: 35% (43/122) vs. 43% (51/120)

- Relative to per cent of MPs in Ontario invested in real estate: 35% (43/122) vs. 43% (51/120)

- MPPs by party

- PC: 34/81 = 42%

- NDP: 6/30 = 20%

- Liberal: 1/7 = 14%

- Green: 1/1 = 100%

- Independent = 1 / 3

MPPs

Deepak Anand

- “Vacant lot: Blue Mountain, ON - 100% interest.”

- “Vacant lots: Lake Simcoe, ON; India - 100% interest.” (spouse/common law)

- Source

Teresa Armstrong

- “Rental income”

- “Investment properties: Residential, London, ON - 50% interest.; Residential, London, ON - 50% interest.”

- “Rental Income” (spouse/common law)

- “Investment properties: Residential, London, ON - 50% interest.; Residential, London, ON - 50% interest.” (spouse/common law)

- Source

Patrice Barnes

- “Investment properties: Residential, Toronto, ON - 50% interest.; Residential, Toronto, ON - 50% interest.”

- “Investment properties: Residential, Toronto, ON - 50% interest.; Residential, Toronto, ON - 50% interest.” (spouse/common law)

- Source

Doly Begum

- “Rental income”

- “Investment properties: Residential, Scarborough, ON - 100% interest.; Residential, Scarborough, ON - 50% interest.”

- “Investment property - Residential, Scarborough, ON - 100% interest.” (spouse/common law)

- Source

Peter Bethlenfalvy

- “Investment income”

- “Rental income”

- “Rental income” (spouse/common law)

- “Investment property - Residential, Naples FL - 100% interest.” (spouse/common law)

- Source

Will Bouma

- “Rental income”

- “Investment property - Residential, St. George, ON - 50% interest.”

- “Rental income” (spouse/common law)

- “Investment property - Residential, St. George, ON” (spouse/common law)

- Source

Stephanie Bowman

- “Assets: Investment and Registered Accounts: Shares - Brookfield Asset Management Inc.”

- Source

Rick Byers

- “Assets: Investment and Registered Accounts: Shares - Brookfield Asset Management Inc.”

- Source

Stan Cho

- “Real Estate Commissions - Royal LePage New Concept (Commissions were for sales activities carried out prior to 2018)”

- “Rental Income”

- “Investment properties: Residential, Toronto, ON - 50% interest.; Residential, Toronto, ON - 100% interest.; Residential, Toronto, ON - 50% interest.; Residential, Toronto, ON - 50% interest.”

- “Investment property - Residential, Toronto, ON - 50% interest.” (spouse/common law)

- Source

Stephen Crawford

- “Investment income”

- “Investment and registered accounts: Brookfield Asset Management Inc.”

- “Sector-specific funds: BMO Equal Weight REITS Index ETF, iShares Capped REIT ETF”; Units – Brookfield Infrastructure Partners, True North Commercial REIT.”

- “Sector-specific funds: iShares Capped REIT ETF” (spouse/common law)

- “Units – True North Commercial REIT” (spouse/common law)

- Source

Rudy Cuzzetto

- “Rental income” (spouse/common law)

- “Investment property: 6 commercial & residential units, Montreal, QC - 50% interest.” (spouse/common law)

- Source

Andrew Dowie

- “Rental income” (spouse/common law)

- “Investment property - residential, Essex, ON - 100% interest.” (spouse/common law)

- Source

Doug Downey

- “Private company - Newfirm Investments Inc. (Holding company that leases property to law firm, Downey Tornosky Lassaline & Timpano Law Professional Corporation.) - 25% interest”

- Source

Vic Fedeli

- “Vacant lot - North Bay, ON - 50% interest.”

- “Vacant lot - North Bay, ON - 50% interest.” (spouse/common law)

- Source

Rob Flack

- “Investment Property - Three parcels of land: Pembroke, ON; WIL CON 18 E; WIL CON 18 W. - 50% interest.”

- “Investment & Registered Accounts: Brookfield Asset Management Inc.”

- “Investment Property - Three parcels of land: Pembroke, ON; WIL CON 18 E; WIL CON 18 W. - 50% interest.” (spouse/common law)

- “Investment & Registered Accounts: Brookfield Asset Management Inc.” (spouse/common law)

- Source

Parm Gill

- “Rental income”

- “Investment Property - Thorold, ON - 100% interest.”

- Source

Chris Glover

- “Rental income”

- “Investment properties: Residential, Toronto, ON - 100% interest; residential, Montreal, QC - 1% interest.”

- Source

Hardeep Grewal

- “Income - Real Estate Hut (real estate commissions)”

- “Rental Income”

- “Investment properties: Residential, Toronto, ON - 100% interest.; Residential, Waterloo, ON - 100% interest.; Residential, Waterloo, ON - 100% interest”

- “Private companies: Landmark Real Estate Centre Inc. - 100% interest (active).”

- “Offices and Directorships: Landmark Real Estate Centre Inc.”

- Source

Ernie Hardeman

- “Investment income”

- “Investment and registered accounts: Units - Hazelview Four Quadrant Global Real Estate Partners, Starlight Hybrid Global Real Assets Trust.”

- “Investment and registered accounts: Sector-specific fund - CI Global REIT Fund.” (spouse/common law)

- Source

Christine Hogarth

- “Investment property - residential, Toronto, ON - 100% interest.”

- “Investment and registered accounts: Sector-specific fund - Real Estate Investment Pool Class I.”

- “Investment and registered accounts: Sector-specific fund - Real Estate Investment Pool Class I.” (spouse/common law)

- Source

Kevin Holland

- “Assets: Investment and Registered Accounts: Sector-specific funds - Thrivent Real Estate Securities.” (spouse/common law)

- Source

Sylvia Jones

- “Assets: Investment and registered accounts: Units – Dream Industrial REIT, Granite REIT, CT REIT.” (spouse/common law)

- “Private companies: Credit Creek Village Inc. - 16% interest - active.; Broadway Village Inc. - 14% interest - active.” (spouse/common law)

- Source

John Jordan

- “Rental Income”

- “Investment Property - Commercial/Residential, Smith Falls, ON - 50% interest”

- “Rental Income” (spouse/common law)

- “Investment Property - Commercial/Residential, Smith Falls, ON - 50% interest” (spouse/common law)

- Source

Logan Kanapathi

- “Rental income”

- “Investment properties: Residential - Keswick, ON - 100% interest.; Residential - Markham, ON - 50% interest.”

- “Rental income” (spouse/common law)

- “Investment property - Residential - Markham, ON - 50% interest.” (spouse/common law)

- Source

Bhutila Karpoche

- “Rental income”

- “Properties: Investment, Toronto, ON - 100% interest; other property, Toronto, ON - 50% interest.”

- Source

Vincent Ke

- “Rental income”

- “Investment property - residential, Aurora, ON - 50% interest.”

- “Rental income”

- “Investment property - residential, Aurora, ON - 50% interest.” (spouse/common law)

- Source

Anthony Leardi

- “Rental income”

- “Investment properties: Commercial, Essex, ON - 50% interest.; Residential, Amherstburg, ON - 50% interest.”

- “Rental income” (spouse/common law)

- “Investment properties: Commercial, Essex, ON - 50% interest.; Residential, Amherstburg, ON - 50% interest.” (spouse/common law)

- “Private company - Harrow Business Office (real estate) - 57 interest (active).” (spouse/common law)

- “Private company - Harrow Business Office (real estate) - 57 interest (active).” (minor child)

- Source

Robin Martin

- “Investment income”

- “Assets: Investment and registered accounts: Shares - Brookfield Asset Management Inc.

- “Assets: Investment and registered accounts: Shares - Brookfield Asset Management Inc., Atrium Mortgage Investment Corp., Blackstone Mortgage Trust Inc.,, Starwood Property Trust Inc.” (spouse/common law)

- Source

Todd McCarthy

- “1012713 Ontario Limited (Real estate related to Flaherty McCarthy LLP) - 18% interest (active).”

- “1061245 Ontario Limited (Commercial tenancy related to Flaherty McCarthy LLP) - 18% interest (active).”

- Source

Monte McNaughton

- “Assets: Investment and registered accounts: Shares - Brookfield Asset Management Inc.” (spouse/common law)

- Source

Billy Pang

- “Rental income”

- “Investment properties: Residential, Toronto, ON - 50% interest.; Residential, Aurora, ON - 50% interest.”

- “Rental income” (spouse/common law)

- “Investment properties: Residential, Toronto, ON - 50% interest.; Residential, Aurora, ON - 50% interest.; Commercial, Toronto, ON - 100% interest.” (spouse/common law)

- Source

Natalie Pierre

- “Rental Income”

- “Investment property - residential, Burlington, ON - 50% interest.”

- “Rental Income” (spouse/common law)

- “Investment property - residential, Burlington, ON - 50% interest.” (spouse/common law)

- Source

Nolan Quinn

- “Rental income”

- “Investment property - residential, Cornwall, ON - 100% interest.”

- Source

Greg Rickford

- “Assets: Investment and registered accounts: Sector-specific fund - Mortgage Company of Canada. Trust units - Centurion Apartment REIT, Rise Properties Trust.”

- “Assets: Investment and registered accounts: Sector-specific funds - Mortgage Company of Canada, YTM Capital Mortgage Income Fund Class F. Trust units - Rise Properties Trust, Slate Securities Real Estate Performance Trust, Centurion Apartment REIT.” (spouse/common law)

- Source

Sheref Sabawy

- “Rental income”

- “Investment properties:Residential - Mississauga, ON - 50% interest; Waterdown, ON - 50% interest; Burlington, ON - 50% interest.”

- “Investment properties:Residential - Mississauga, ON - 50% interest; Waterdown, ON - 50% interest; Burlington, ON - 50% interest.” (spouse/common law)

- Source

Amarjot Sandhu

- “Rental income”

- “Investment property - residential, Brampton, ON - 50% interest.”

- “Income - 2831800 Ontario Inc. (Real estate commissions - Royal LePage Flower City).” (spouse/common law)

- “Rental income” (spouse/common law)

- “Investment property - residential, Brampton, ON - 50% interest.” (spouse/common law)

- Source

Mike Schreiner

- “Rental Income”

- Source

Sandy Shaw

- “Rental income”

- “Investment property - residential, Hamilton, ON - 100% interest.”

- Source

Donna Skelly

- “Rental Income”

- “Investment property - commercial, Hamilton, ON - 70% interest.”

- Source

Laura Smith

- “Investment income”

- “Investment and Registered Accounts: Shares - Brookfield Asset Management Inc.”

- “Units - Canadian Apartment Properties REIT, InterRent REIT, Minto Apartment REIT, BSR REIT, Brookfield Infrastructure Partners.”

- “Investment income” (spouse/common law)

- “Investment and Registered Accounts: Shares - Brookfield Asset Management Inc., Tricon Residential Inc.” (spouse/common law)

- “Units - Canadian Apartment Properties REIT, BSR REIT, InterRent REIT, Chartwell Retirement Residences, Killiam Apartment REIT, Minto Apartment REIT, Summit Industrial Income REIT, Automotive Properties REIT, Flagship Communities REIT, Sun Communities REIT” (spouse/common law)

- Source

Nina Tangri

- “Rental income”

- Source

Michael Tibollo

- “Guarantor for Yonge Street Holdings Limited - IC Savings.”

- “Guarantor for Immobiliare MSF Inc. - IC Savings.”

- “Guarantor for Tri-Matrix Corporation - Moya Financial Credit Union.”

- “Private companies: Yonge Street Holdings Limited - Real Estate - 100% interest (active). Yonge Street Holdings has a lease agreement with the Ministry of the Solicitor General.; Immobiliare MSF Inc. - Real Estate - 100% interest (active).; Tri-Matrix Corporation - Real Estate - 100% interest (active).” (spouse/common law)

- Source

John Vanthof

- “Agricultural property: Lots 8 and 9 Concession 1, Evanturel - 50% interest.”

- “Rental income” (spouse/common law)

- “Agricultural and investment property: Lots 8 and 9, Concession 1, Evanturel - 50% interest; Lot 9, Concession 1, Evantural (separate parcel) - 100% interest.”

- Source

Quebec

- Details: Quebec makes public disclosures for MNAs accessible online, with PDF reports available for each one (in French only). The reports were prepared in 2023 to cover 2021-2022.

- Notes: The Quebec legislature had one vacancy at the time this data was captured. As a result, the number of total MNA disclosures reviewed was 124 instead of 125.

- Total MNAs: 26/124 = 21%

- Relative to per cent of MPs in Quebec invested in real estate: 21% (26/124) vs. 30% (23/77)

- Relative to per cent of MPs in Quebec invested in real estate: 21% (26/124) vs. 30% (23/77)

- MNAs by party

- CAQ: 20/89 = 22%

- Liberal: 3/19 = 16%

- Québec solidaire: 2/12 = 17%

- Parti Québécois: 1/3 = 33%

MNAs

Alice Abou-Khalil

- “Courtière immobilière, Alice Abou-Khalil inc.”

- Source

Frantz Benjamin

- “Revenu de location: Immeuble résidentiel”

- Source

Maïté Blanchette Vézina

- “Immeubles détenus à des fins résidentielles personnelles et locatives”

- “Location d’un immeuble à des fins résidentielles.”

- Source

Lionel Carmant

- “Revenus de location: Immeubles résidentiels”

- Source

Vincent Caron

- “Revenu de location: Immeuble résidentiel”

- Source

Youri Chassin

- “Revenu de location: Immeuble résidentiel”

- Source

Monsef Derraji

- “Revenu de location: Immeuble résidentiel”

- Source

Pascale Déry

- “Revenu de location: Immeuble résidentiel”

- Source

Christian Dubé

- “Revenu de location: Immeuble résidentiel”

- Source

Virginie Dufour

- “Revenu de location: Immeuble résidentiel”

- Source

France-Élaine Duranceau

- “Revenu à titre de courtière en immobilier commercial: Cushman & Wakefield.”

- Source

Christine Fréchette

- “Revenus de location: Immeubles résidentiels”

- Source

Nancy Guillemette

- “Revenus de location: Immeubles résidentiels”

- Source

Chantale Jeannotte

- “Revenu de location: Immeuble résidentiel”

- Source

Christine Labrie

- “Revenus de location: Immeubles résidentiels”

- Source

André Lamontagne

- “Immeubles détenus à des fins résidentielles personnelles et locatives”

- “Société immobilière Decolam, actionnaire d’une entreprise dont les titres ne sont pas transigés à une bourse.”

- Source

Lucie Lecours

- “Revenus de location: Immeuble résidentiels”

- Source

Éric Lefebvre

- “Revenus de location: Immeuble résidentiels”

- Source

Mathieu Lévesque

- “Revenus de location: Immeuble résidentiels”

- Source

Vincent Marissal

- “Revenu de location: Immeuble résidentiel”

- Source

Luc Provençal

- “Revenu de location: Immeuble résidentiel”

- Source

Mathieu Rivest

- “Revenu de location: Immeuble résidentiel”

- Source

Christopher Skeete

- “Revenu de location: Immeuble résidentiel”

- Source

Chantal Soucy

- “Revenu de location: Immeuble résidentiel”

- Source

Paul St-Pierre Plamondon

- “Revenus de location: Immeuble résidentiels”

- Source

Louis-Charles Thouin

- “Revenu de location: Immeuble résidentiel”

- Source

British Columbia

- Details: British Columbia makes public disclosures for MLAs accessible online, with PDF reports available for each one. The reports were submitted in 2023.

- Notes: Disclosures for two recently-elected MLAs (Ravi Parmar and Joan Philip) in the British Columbia legislature were not available at the time this data was captured. As a result, the number of total MLA disclosures reviewed was 85 instead of 87.

- Total MLAs: 35/85 = 41%

- Relative to per cent of MPs in British Columbia invested in real estate: 41% (35/85) vs. 36% (15/42)

- Relative to per cent of MPs in British Columbia invested in real estate: 41% (35/85) vs. 36% (15/42)

- MLAs by party

- NDP: 21/55 = 38%

- BC United: 12/27 = 44%

- Green: 1/2 = 50%

- Conservative = 1 / 1

MLAs

Brittny Anderson

- “Rental income”

- “Rental suite in home, Castlegar, BC”

- Source

Michele Babchuk

- “Investment property in Campbell River, BC” (Member and spouse)

- Source

Brenda Bailey

- “Rental income”

- “Investment property and expected future residence in Saanich, BC”

- Source

Bruce Banman

- “Rental income” (Member and spouse)

- Source

Mike Bernier

- “Jomic Enterprises Ltd. - Residential Development Company” - “Member owns 50% and is President; Spouse owns 50% and is Secretary/Vice President”

- Source

Jagrup Brar

- “Residential property - rental income” (Member and spouse)

- “Investment properties: Fort Saskatchewan, AB (Member and spouse), Quarter joint ownership of family farm in Village Deon, Punjab, India (Member)”

- “Frejno Holding Ltd. - Land Development” - “Member owns 50% and is Director and Secretary-Treasurer; Spouse owns 50% and is Director and President”

- Source

Spencer Chandra Herbert

- “Rental income” (Spouse)

- “Investment property in Vancouver, BC” (Member and Spouse)

- Source

Susie Chant

- “Rental income - Victoria condo”

- “Investment property in North Vancouver, BC - rental income” (Member and spouse)

- “Investment properties in Glace Bay, Nova Scotia - rental income” (Spouse)

- Source

Katrina Chen

- “Rental income - from residential property in Vancouver, BC”

- Source

Raj Chouhan

- “Vacant lot to become residence following construction - Burnaby, BC” (Member and spouse)

- Source

Doug Clovechok

- “Investment property - Calgary, AB”

- Source

Katrine Conroy

- “Grazing land”

- Source

Bob D’Eith

- “Investment property - Langley, BC” (Spouse)

- Source

Michael de Jong

- “Rental income” (Spouse)

- “Investment property - Cry Sur Armancon, France” (Spouse)

- Source

Fin Donnelly

- “Investment property - Port Moody, BC - joint ownership (80%)” (Member)

- “Investment property - Coquitlam, BC - joint ownership (20%)” (Member and spouse)”

- Source

Kevin Falcon

- “Calgary, AB - rental income”

- “Coquitlam, BC - rental income” (Member and spouse)

- “Investment property - Coquitlam, BC” (Member and spouse)

- “Other property - Calgary, AB”

- Source

Sonia Furstenau

- “Rental income” (Spouse)

- “Investment property - Victoria, BC” (Spouse)

- “Investment property - Mill Bay, BC” (Member and Spouse)

- Source

Trevor Halford

- “Investment property - White Rock, BC - business” (Member and spouse)

- Source

George Heyman

- “In-home studio suite - rental income”

- Source

Karin Kirkpatrick

- “Qualicum Beach, BC - rental income” (Member and spouse)

- “Vancouver, BC - rental income” (Member and spouse)

- Investment properties - “Qualicum Beach, BC”; “Vancouver, BC” (Member and spouse)

- Source

Norm Letnick

- “Rental income” (Spouse)

- “Investment property - Kelowna, BC” (Spouse)

- Source

Grace Lore

- “Income from rental suite” (Member and spouse)

- Source

Renee Merrifield

- “Income: Troika Management Corp. - dividends (Spouse) Troika Management Corp. - salary”

- “Shareholder Loans: Troika Management Corp. CorWest Builders Inc. Troiwest Builders Inc.”

- “Controlled Private Corporations:

- Risorgimento Holdings Inc - Holding company Ownership - Member owns 100% and is President & Secretary

- Corwest Builders Inc - construction company Ownership - Member owns 85% and is President & Secretary

- Troiwest Builders Inc - construction company Ownership - Member owns 25% and is President & Director”

- “Controlled Private Corporations: “Risorgimento Holdings Inc. Affiliated Corporations: Troika Management Corp; TMC Prairie Development Inc.; Troika Ventures Inc.; Green Square Development Ltd.; Troika Developments (SK) Inc.; Stewart Greens Development Ltd.; Troika WH Developments Inc.; Troika Development Inc.; 1226903 BC Ltd.; 0720229 BC Ltd.; 1145429 BC Ltd.; 1172031 BC Ltd.; Kelfield Development Corp.”

- “Real Property Interests: Kelowna, BC - lot Big White, BC – lot Interests in Other Corporations 50% ownership of High Altitude Vacation Properties Ltd.”

- Source

Josie Osborne

- “Rental income” (Member and spouse)

- Source

Ian Paton

- “Vacant land - Delta, BC” (Member and spouse)

- Source

Murray Rankin

- “Rental income” (Member and spouse)

- “Investment properties - 2 units, Victoria, BC” (Member and spouse)

- “Other property: half interest in lot on north side of Loreto Beach, BCS, Mexico”

- Source

Jennifer Rice

- “Rental income” (Member and spouse)

- “Investment property in Rupert, BC” (Member and spouse)

- Source

Janet Routledge

- “Investment property - Whistler, BC - Timeshare” (Member and spouse)

- Source

Roly Russell

- “1290232 B.C. Ltd. - commercial and residential property management. Ownership - Member owns 25% of voting shares, 25% of non-voting shares; Spouse owns 25% of voting shares, 25% of non-voting shares”

- “1290232 B.C. Ltd. - revenue from residential and commercial leases”

- “Real property interests: Similkameen Division Yale District Plan 42989 - lot”

- Source

John Rustad

- “Wood lot licence, Isle Pierre, BC”

- “Other Land: 1. DL 9251 Cariboo Land District, Isle Pierre Rd 2. Part W ½ of NE ¼ DL 834, Nechako River 3. Part SE ¼ DL 3034, Cariboo Land District, Cole Bank Rd 4. Part NE ¼ DL 3034, Cariboo Land District, Cole Bank Rd”

- Source

Niki Sharma

- “Investment Property - Vancouver BC - co-owner with family member”

- Source

Aman Singh

- “Basement of Residential Property - rental income”

- Source

Todd Stone

- Shares: “Choice Properties Real Estate Investment Trust Units”; “First Capital Real Estate”; “Boardwalk Real Estate; Smartcentres Real Estate”

- Source

Teresa Wat

- “Rental/Parking Income - Investment Property”

- “Investment Property - Vancouver, BC”

- “Other Property - purchase rights for property that may become personal residence once construction completed - Richmond, BC”

- Source and source

Jennifer Whiteside

- “Rental income from investment property in Montreal, QC” (Spouse)

- “Rental income from residential property in Montreal, QC” (Member and spouse)

- “Investment Property - Montreal, QC” (Spouse)

- Source

Alberta

- Details: Alberta makes public disclosures for MLAs accessible online, with PDF reports available for each one. The reports are from 2023.

- Notes: Twelve disclosures were not available at the time this data was captured (Nagwan Al-Guneid, Andrew Boitchenko, Gurinder Brar, Jodi Calahoo Stonehouse, Sharif Haji, Julia Hayter, Nathan Ip, Matt Jones, Myles McDougall, Luanne Metz, Chelsea Petrovic, Peggy Wright). As a result, the number of total MLA disclosures reviewed was 75 instead of 87.

- Total MLAs: 27/75 = 36%

- Relative to per cent of MPs in Alberta invested in real estate: 36% (27/75) vs. 48% (16/33)

- Relative to per cent of MPs in Alberta invested in real estate: 36% (27/75) vs. 48% (16/33)

- MLAs by party

- UCP: 19/44 = 43%

- NDP: 8/30 = 27%

MLAs

Mickey Amery

- “Other property: in a management arrangement agreement approved by the Ethics Commissioner of Alberta”

- “Rental Income” (spouse/common law)

- “Rental: Calgary, AB” (spouse/common law)

- Source

Jackie Armstrong-Homeniuk

- “Fifth Avenue Holdings - Real Property - Rental Building”

- Source

Eric Bouchard

- “Rental Income”

- “Rental Properties: Calgary (2), Airdrie (1)”

- Source

Lorne Dach

- “Rental Income”

- “Rental Property: Edmonton”

- Source

Jasvir Deol

- “Rental Income”

- “Rental Property: Edmonton, AB”

- “Rental Income” (spouse/common law)

- “Rental property: Joint with Spouse” (spouse/common law)

- Source

Devin Dreeshen

- “Farming Land”

- Source

Nolan Dyck

- “Rental Income”

- “Rental Properties: 2”

- “Rental Income” (spouse/common law)

- Source

Court Ellingson

- “Rental Income”

- “Rental Properties: Calgary (2)”

- Source

Mike Ellis

- Rental income

- “Rental Property: In a management arrangement approved by the Ethics Commissioner of Alberta”

- “Rental Property: Joint with Spouse” (spouse/common law)

- Source

Peter Guthrie

- Rental Income, joint with spouse

- Source

Sarah Hoffman

- “Rental Property: Edmonton”

- “Pts. of 2 x ¼ sections in Sturgeon County”

- Source

Nathan Horner

- “Leased and owned lands: Special Areas”

- Source

Brian Jean

- City Centre Group Inc - Income - Rental

- Source

Adriana LaGrange

- “Real property: In blind trust approved by Ethics Commissioner of Alberta”

- “Rental property” (spouse/common law)

- Source

Ric McIver

- “Rental Income” (spouse/common law)

- Source

Nathan Neudorf

- “Rental Income”

- “Rental Property: In a management arrangement approved by the Ethics Commissioner of Alberta”

- Source

Rachel Notley

- “Income - Rental Property - Rent” (spouse/common law)

- “Rental Property” (spouse/common law)

- Source

Rajan Sawhney

- “Rental Property: Rockyview County” (spouse/common law)

- Source

Lori Sigurdson

- “Rental Income”

- “Rental Property: Edmonton”

- Source

Pradeep (Peter) Singh

- “Rental Income”

- “Rental Property- Calgary” (Joint with Spouse)

- “Agriculture Land: Saskatchewan” (Joint with Spouse)

- Source

Jason Stephan

- “Other Property- Bahamas”

- “Jason Stephan Professional Corp. - Real Property - Red Deer, AB”

- “Lambourne Environmental Ltd.) - Real Property - Red Deer, AB”

- “Rental income” (spouse/common law)

- “Rental Property: Red Deer AB (2)” (spouse/common law)

- Source

Heather Sweet

- “Rental Property”

- “Rental Property: Edmonton (1)”

- Source

Searle Turton

- “Rental Income” (Joint with Spouse)

- “Rental Property: Edmonton, AB” (Joint with Spouse)

- Source

Glenn van Dijken

- “Harmony Farms Inc. - Real Property - Westlock County: Pts. of 11 x ¼ sections (own and lease)”

- Source

Ron Wiebe

- “Wiebe Group Investment Corp - Real Property - Grande Prairie”

- “MRON Investment Corp. - Real Property - MD of MacKenzie”

- Source

Richard Wilson

- “Other properties” (Joint with Spouse)

- “Viewland Resorts Holdings Ltd. - Real Property - Hawaii, Other property”

- Source

Tany Yao

- “Income: Rent”

- “Rental: Edmonton, Calgary, Ft. McMurray”

- “Other Property”

- Source

Saskatchewan

- Details: Saskatchewan makes public disclosures for MLAs accessible online, with PDF reports available for each one. The reports are from 2022.

- Notes: The disclosure of one MLA (Doug Steele) in the Saskatchewan legislature was not available at the time this data was captured. In addition, the Saskatchewan legislature had three vacancies at the time this data was captured. As a result, the number of total MLA disclosures reviewed was 57 instead of 61.

- Total MLAs: 31/57 = 54%

- Relative to per cent of MPs in Saskatchewan invested in real estate: 54% (31/57) vs. 43% (6/14)

- Relative to per cent of MPs in Saskatchewan invested in real estate: 54% (31/57) vs. 43% (6/14)

- MLAs by party

- Saskatchewan Party: 26/45 = 58%

- NDP: 4/12 = 33%

- Saskatchewan United Party = 1 / 1

MLAs

Steven Bonk

- “Land Rental”

- Source

Fred Bradshaw

- “SW 5-49-11 W 2nd: Joint Owner”

- “S 6-49-11 W 2nd: Owner”

- “18-48-11 W 2nd: Owner”

- “NW 32-48-11 W 2nd: Owner”

- “NE 24-50-10 W 2nd: Owner” (Spouse/common law)

- “SW 5-49-11 W 2nd: Joint Owner” (Spouse/common law)

- Source

Ken Cheveldayoff

- “Millennium Property Group: Limited Partnership”

- “NW 11-45-6 W 3rd: Owner”

- “SW 11-45-6 W 3rd: Owner”

- “ReDev Properties” (Spouse/common law)

- Source

Jeremy Cockrill

- “Rental property income - 102 18th St. W., Battleford, SK - Joint Owner”

- “102064168 Saskatchewan Ltd. - assets: real estate holding company [...] shareholder”

- “102064168 Saskatchewan Ltd. - assets: real estate holding company [...] shareholder” (spouse/common law)

- “1109179 BC Ltd. - assets: real estate holding company [...] shareholder” (spouse/common law)

- “1001318 BC Ltd. - assets: real estate holding company [...] shareholder” (spouse/common law)

- Source

Terry Dennis

- “3 lots on Railway Ave., Canora, SK - Owner”

- Source

Ryan Domotor

- “Lot 8, Block 19, Plan No. 59B03278 Turtleford, SK - Joint Owner”

- “Lot 8, Block 19, Plan No. 59B03278 Turtleford, SK - Joint Owner” (Dependent Child)

- Source

Muhammad Fiaz

- “4122 Castle Road, Regina, SK - Joint Owner”

- “1566 Cameron Street, Regina, SK - Owner”

- “1460 Edward Street, Regina, SK - Owner”

- “1556 Robinson Street, Regina, SK - Owner”

- “4122 Castle Road, Regina, SK - Joint Owner” (spouse/common law)

- Source

Ken Francis

- “2K3D Investments Inc. - assets: real estate” Shareholder and president/director

- “819 - 9th St. W., Kindersley, SK” (Through 2K3D)

- “128 - 1st Ave. W., Kindersley, SK” (Through 2K3D)

- “2600 - 8th St. E., Kindersley, SK” (Through 2K3D)

- “311 Main St., Kindersley, SK” (Through 2K3D)

- “121, 137, 145, 151, 1st Ave. NE., Swift Current, SK” (Through 2K3D)

- “116, 117, 118 - 3rd Ave. W., Kindersley, SK.” (Through 2K3D)

- “1130 Rempel Place, Kindersley, SK” (Through 2K3D)

- “3404 - 205 Third Ave., Invermere, BC” (Through 2K3D)

- “G-106 Papakea Resort, Lahaina, Maui, Hawaii, USA” (Through 2K3D)

- “2K3D Investments Inc. - assets: real estate” Secretary-treasurer (spouse/common law)

- “819 - 9th St. W., Kindersley, SK” (Through 2K3D) (spouse/common law)

- “128 - 1st Ave. W., Kindersley, SK” (Through 2K3D) (spouse/common law)

- “2600 - 8th St. E., Kindersley, SK” (Through 2K3D) (spouse/common law)

- “311 Main St., Kindersley, SK” (Through 2K3D) (spouse/common law)

- “121, 137, 145, 151, 1st Ave. NE., Swift Current, SK” (Through 2K3D) (spouse/common law)

- “116, 117, 118 - 3rd Ave. W., Kindersley, SK.” (Through 2K3D) (spouse/common law)

- “1130 Rempel Place, Kindersley, SK” (Through 2K3D) (spouse/common law)

- “3404 - 205 Third Ave., Invermere, BC” (Through 2K3D) (spouse/common law)

- “G-106 Papakea Resort, Lahaina, Maui, Hawaii, USA” (Through 2K3D) (spouse/common law)

- Source

Gary Grewal

- “Rental properties: Regina, SK” (spouse/common law)

- “58/60 Froom Crescent, Regina, SK - owner” (spouse/common law)

- Source

Joe Hargrave

- Income from Hargrave Holdings Ltd., a real estate holding company

- President and shareholder of Hargrave Holdings Ltd.

- “NW 11-55-22 W 2nd - owner”

- “201, 211, and 213 Burrows Ave. W., Melfort, SK - Joint owner through Hargrave Holdings Ltd. - Joint owner”

- Income from Hargrave Holdings Ltd., a real estate holding company (spouse/common law)

- Secretary and shareholder of Hargrave Holdings Ltd. (spouse/common law)

- “201, 211, and 213 Burrows Ave. W., Melfort, SK - Joint owner through Hargrave Holdings Ltd. - Joint owner” (spouse/common law)

- Source

Daryl Harrison

- “11-5-34 W 1st - Joint Owner”

- “NE 10-5-34 W 1st - Joint Owner”

- “SW 12-5-33 W 1st - Joint Owner”

- “NE 10-5-1 W 1st - Joint Owner”

- “SE 14-4-34 W 1st - Joint Owner”

- “11-5-34 W 1st - Joint Owner” (spouse/common law)

- “NE 10-5-34 W 1st - Joint Owner” (spouse/common law)

- “NE 10-5-1 W 1st - Joint Owner” (spouse/common law)

- “SE 14-4-34 W 1st - Joint Owner” (spouse/common law)

- Source

Warren Kaeding

- President of 101200573 Saskatchewan Ltd.

- “101200573 Saskatchewan Ltd. - assets: Royal Estates Churchbridge (rental properties) - Shareholder”

- “Royal Estates Churchbridge - Lot H, Bloc 24, Plan 101819471, Lot I, Block 24, Plan 1021133965 - Joint Owner through 101200573 Saskatchewan Ltd.”

- “NW 6-22-32 W 1st - Joint Owner”

- “Royal Estates Churchbridge - Lot H, Bloc 24, Plan 101819471, Lot I, Block 24, Plan 1021133965 - Joint Owner through 101200573 Saskatchewan Ltd.” (spouse/common law)

- “NW 6-22-32 W 1st - Joint Owner” (spouse/common law)

- Source

Travis Keisig

- “NW 25-23-12 W 2nd - Joint Owner”

- “SE 26-23-12 W 2nd - Joint Owner”

- “SW 26-23-12 W 2nd - Joint Owner”

- “NE 34-23-12 W 2nd - Joint Owner”

- “NW 34-23-12 W 2nd - Joint Owner”

- “SW 34-23-12 W 2nd - Joint Owner”

- “NW 35-23-12 W 2nd - Joint Owner”

- “SW 35-23-12 W 2nd - Joint Owner”

- “SW 36-23-12 W 2nd - Joint Owner”

- “NW 25-23-12 W 2nd - Joint Owner” (spouse/common law)

- “SE 26-23-12 W 2nd - Joint Owner” (spouse/common law)

- “SW 26-23-12 W 2nd - Joint Owner” (spouse/common law)

- “NE 34-23-12 W 2nd - Joint Owner” (spouse/common law)

- “NW 34-23-12 W 2nd - Joint Owner” (spouse/common law)

- “SW 34-23-12 W 2nd - Joint Owner” (spouse/common law)

- “NW 35-23-12 W 2nd - Joint Owner” (spouse/common law)

- “SW 35-23-12 W 2nd - Joint Owner” (spouse/common law)

- “SW 36-23-12 W 2nd - Joint Owner” (spouse/common law)

- Source

Delbert Kirsch

- “NE 7-40-24 W 2nd - Owner”

- “NW 9-40-24 W 2nd - Owner”

- “SW 15-40-24 W 2nd - Owner”

- “SW 16-40-24 W 2nd - Joint Owner”

- “NE 4-40-24 W 2nd - Joint Owner”

- “SE 4-40-24 W 2nd - Joint Owner”

- “SW 4-40-24 W 2nd - Joint Owner”

- “NW 4-40-24 W 2nd - Joint Owner”

- “SW 9-40-24 W 2nd - Joint Owner”

- “NW 33-39-24 W 2nd - Joint Owner”

- “SW 16-40-24 W 2nd - Joint Owner” (spouse/common law)

- “NW 33-39-24 W 2nd - Joint Owner” (spouse/common law)

- Source

Jim Lemaigre

- “Rental Income - La Loche, SK - Joint Owner”

- “Lots 12 and 15, La Loche, SK - Joint Owner”

- “Rental Income - La Loche, SK - Joint Owner” (spouse/common law)

- “Lots 12 and 15, La Loche, SK - Joint Owner” (spouse/common law)

- Source

Gene Makowsky

- “2803 Truesdale Dr., Regina, SK - Joint Owner”

- Source

David Marit

- “Farm land rental - Saskatchewan - Owner”

- President of David Marit Holdings

- “David Marit Holdings -assets: land and equity”

- “All of 2-2-28 W 2nd - Owner”

- “E ½ 7-4-28 W 2nd - Owner”

- Vice-President of David Marit Holdings (spouse/common law)

- Source

Scott Moe

- Shareholder and director of 101078517 Saskatchewan Ltd. (spouse/common law)

- “Thiel Enterprise [...] Shareholder” (spouse/common law)

- “207 3rd Ave. W., Shellbrook, SK (Through 101078517 Saskatchewan Ltd.)” (spouse/common law)

- “209 3rd Ave. W., Shellbrook, SK (Through 101078517 Saskatchewan Ltd.)” (spouse/common law)

- “216 3rd Ave. W., Shellbrook, SK (Through 101078517 Saskatchewan Ltd.)” (spouse/common law)

- “202 3rd Ave. W., Shellbrook, SK (Through 101078517 Saskatchewan Ltd.)” (spouse/common law)

- “206 3rd Ave. W., Shellbrook, SK (Through 101078517 Saskatchewan Ltd.)” (spouse/common law)

- “NW 10-4-46 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “NE 31-4-48 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “NW 32-4-48 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “SE 31-4-48 W 3d (Through Thiel Enterprise)” (spouse/common law)

- “SW 31-4-48 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “SE 30-4-48 W W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “NE 13-3-49 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “NW 13-3-49 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “SE 13-3-49 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- “NW 19-3-49 W 3rd (Through Thiel Enterprise)” (spouse/common law)

- Source

Don Morgan

- Director of JD Morgan Investments Ltd.

- “JD Morgan Investments Ltd. - Assets: real estate - Shareholder”

- Director of 101154864 Sask Ltd.

- Director of 101154865 Sask Ltd.

- “101154865 Sask Ltd. - Assets: rental properties - Shareholder”

- “2124 Cecilia Ave. Saskatoon, SK - Through 101154864 Sask Ltd.”

- “131/133 Coppermine Court, Saskatoon, SK - Through 101154864 Sask Ltd.”

- Director of 101154865 Sask Ltd. (spouse/common law)

- “101154865 Sask Ltd. - Assets: rental properties - Shareholder” (spouse/common law)

- Director of 101154864 Sask Ltd. (spouse/common law)

- “2124 Cecilia Ave. Saskatoon, SK - Through 101154864 Sask Ltd.” (spouse/common law)

- “131/133 Coppermine Court, Saskatoon, SK - Through 101154864 Sask Ltd.” (spouse/common law)

- “NE 19-31-16 W 3rd - Owner” (spouse/common law)

- “Bkl/Par B Plan 01MW16192 - Joint Owner” (spouse/common law)

- “LSD 1 of 20-31-16 W 3rd - Owner” (spouse/common law)

- “LSD 2 of 20-31-16 W 3rd - Owner” (spouse/common law)

- Source

Vicki Mowat

- “Rental Income - 522 Ave X. S., Saskatoon, SK S7M 4X9 - Owner”

- Source

Hugh Nerlien

- “327 Elm St., Porcupine Plain, SK - Joint Owner”

- Source

Greg Ottenbreit

- President of GLO Enterprises

- “GLO Enterprises - Assets: rental property:

- “56 South Front St., Yorkton, SK - Joint Owner (through GLO Enterprises Ltd.)”

- “157 Laurier Ave., Yorkton, SK - Joint Owner (Personal Rental)”

- “Lot 6, Blk 2 Plan 102096187, NW 26-25-03 W 2nd - Joint Owner”

- “Lot G, Blk 2 Plan 94Y07119, SW 23-26-04 W 2nd - Joint Owner”

- “33 Foster Street, Yorkton, SK - Through GLO Enterprises Ltd.”

- “Rental income - Yorkton, Yorkton, SK - Joint Owner” (spouse/common law)

- Secretary of GLO Enterprises (spouse/common law)

- “56 South Front St., Yorkton, SK - Joint Owner (through GLO Enterprises Ltd.)” (spouse/common law)

- “157 Laurier Ave., Yorkton, SK - Joint Owner (Personal Rental)” (spouse/common law)

- “Lot 6, Blk 2 Plan 102096187, NW 26-25-03 W 2nd - Joint Owner” (spouse/common law)

- “Lot G, Blk 2 Plan 94Y07119, SW 23-26-04 W 2nd - Joint Owner” (spouse/common law)

- “West ½ of NW 1-29-5 W 2nd - Joint Owner” (spouse/common law)

- Source

Jim Reiter

- “SE 6-36-20 W 3rd - Joint Owner”

- Source

Laura Ross

- “Rental Income - 4059 Elphinstone St., Regina, SK - Joint Owner”

- “Rental Income - 12 Wintergreen Bay, Regina, SK - Joint Owner”

- “Rental Income - 4059 Elphinstone St., Regina, SK - Joint Owner” (spouse/common law)

- “Rental Income - 12 Wintergreen Bay, Regina, SK - Joint Owner” (spouse/common law)

- Source

Dana Skoropad

- “NW 22-21-26 W 2nd - Owner”

- “SE 03-16-26 W 2nd - Joint Owner” (spouse/common law)

- “SE 19-17-25 W 2nd - Share of mineral rights” (spouse/common law)

- “SW 02-16-26 W 2nd - Share of mineral rights” (spouse/common law)

- “NW 02-16-26 W 2nd - Share of mineral rights” (spouse/common law)

- Source

Christine Tell

- “2136 Wallace St., Regina, SK - Owner”

- “467 Froom Cres., Regina, SK - Joint Owner”

- “2136 Reynolds St., Regina, SK - Owner”

- Source

Doyle Vermette

- “Lot B, Block 33, Air Ronge, Saskatchewan - Owner” (spouse/common law)

- Source

Nadine Wilson

- “Income - Family farm - R.R. 5, Site 15, Box 2, Prince Albert, SK S6V 5R3 - Joint owner”

- “SW 12-53-25 W 2nd - Joint Owner”

- “SE 12-53-25 W 2nd - Joint Owner”

- “SW 13-53-25 W 2nd - Joint Owner”

- “NE 14-53-25 W 2nd - Joint Owner”

- “SE 14-53-25 W 2nd - Joint Owner”

- “NW 02-53-25 W 2nd - Joint Owner”

- “SE 35-50-28 W 2nd - Joint Owner”

- “NE 35-53-28 W 2nd - Joint Owner”

- “NW 36-50-28 W 2nd - Joint Owner”

- “SW 17-53-25 W 2nd - Joint Owner”

- “N 1/2 04-46-27 W 2nd - Joint Owner”

- “SW 04-46-27 W 2nd - Joint Owner”

- “SW 06-51-27 W 2nd - Joint Owner”

- “NE 35-50-28 W 2nd - Joint Owner”

- “NW 12-53-25 W 2nd - Joint Owner”

- “Lots 6 & 7, Block 105, Panther Parkway - Van Impe Estates, Candle Lake, SK Joint Owner”

- “Income - Family farm - R.R. 5, Site 15, Box 2, Prince Albert, SK S6V 5R3 - Joint owner” (spouse/common law)

- “SW 12-53-25 W 2nd - Joint Owner” (spouse/common law)

- “SE 12-53-25 W 2nd - Joint Owner” (spouse/common law)

- “SW 13-53-25 W 2nd - Joint Owner” (spouse/common law)

- “NE 14-53-25 W 2nd - Joint Owner” (spouse/common law)

- “SE 14-53-25 W 2nd - Joint Owner” (spouse/common law)

- “NW 02-53-25 W 2nd - Joint Owner” (spouse/common law)

- “SE 35-50-28 W 2nd - Joint Owner” (spouse/common law)

- “NE 35-53-28 W 2nd - Joint Owner” (spouse/common law)

- “NW 36-50-28 W 2nd - Joint Owner” (spouse/common law)

- “SW 17-53-25 W 2nd - Joint Owner” (spouse/common law)

- “N 1/2 04-46-27 W 2nd - Joint Owner” (spouse/common law)

- “SW 04-46-27 W 2nd - Joint Owner” (spouse/common law)

- “SW 06-51-27 W 2nd - Joint Owner” (spouse/common law)

- “NE 35-50-28 W 2nd - Joint Owner” (spouse/common law)

- “NW 12-53-25 W 2nd - Joint Owner” (spouse/common law)

- “Lots 6 & 7, Block 105, Panther Parkway - Van Impe Estates, Candle Lake, SK Joint Owner” (spouse/common law)

- Source

Trent Wotherspoon

- “NE 16-23-23 W 2nd Ext. 16 - Joint Owner”

- “NE 16-23-23 W 2nd Ext. 18 - Joint Owner”

- “NE 16-23-23 W 2nd Ext. 16 - Joint Owner” (spouse/common law)

- “NE 16-23-23 W 2nd Ext. 18 - Joint Owner” (spouse/common law)

- Source

Gordon Wyant

- “1208 - 311 6th Av. N., Saskatoon, SK - Freehold*” (spouse/common law)

- “1101 - 311 6th Ave. N., Saskatoon, SK - Freehold*” (spouse/common law)

- “701 - 311 6th Ave. N., Saskatoon, SK - Freehold*” (spouse/common law)

- “1801 - 311 6th Ave. N., Saskatoon, SK - Freehold*” (spouse/common law)

- “231 - 23rd St. E., Saskatoon, SK - Freehold***” (spouse/common law)

- “200 - 4th Ave. N., Saskatoon, SK - Freehold****” (spouse/common law)

- “* Hrudka Holdings Ltd. is a company wholly owned by Christine Hrudka”

- “*** Christine Hrudka”

- “**** Through 101163100 Saskatchewan Ltd.”

- Source

Aleana Young

- “637 Broadway Ave., Regina, SK - Joint Owner”

- “2115 Queen St., Regina, SK - Joint Owner”

- “637 Broadway Ave., Regina, SK - Joint Owner” (spouse/common law)

- “5790 Patterson Ave., Vancouver, BC - Joint Owner” (spouse/common law)

- “Lawaii Beach Resort, Hawaii, USA - Shareholder” (spouse/common law)

- Source

Nova Scotia

- Details: Nova Scotia makes public disclosures for MLAs accessible online, contained in a single, non-searchable PDF. The PDF includes reports made throughout 2022. However, these reports only contain new information, and do not reiterate information provided on past claims. This means that, for example, an MLA elected in 2013 who reported rental income would not have to do so again for the same property in subsequent disclosures. As such, the current disclosures likely undercount the number of MLAs who earn rental income and/or own rental property. Because past disclosures are not available online, the current one becomes less useful.

- Total MLAs: 7/55 = 13%

- Relative to per cent of MPs in Nova Scotia invested in real estate: 13% (7/55) vs. 36% (4/11)

- Relative to per cent of MPs in Nova Scotia invested in real estate: 13% (7/55) vs. 36% (4/11)

- MLAs by party

- PC: 5/32 = 16%

- Liberal: 1/16 = 6%

- NDP: 1 / 6 = 17%

MLAs

Jill Balser

- “Saint John, NB: Rental property”

- Source

Rafah DiCostanzo

- “Embassy Towers Apt 1604: Part owner”

- Source

Tim Houston

- “Bell Aliant [...] Landlord”

- Source

Lisa Lachance

- “2554 Oxford St: Co-owner”

- “569 Pereau Rd: Co-owner”

- Source

John Lohr

- “116 Bessie North Road Canning: 46 Acre Woodlot”

- 1093 Kars St Port Williams: 3 unit apartment co owned with Julie Lohr”

- Source

Kent Smith

- “23555 Hwy 7, Watt Section: Rent”

- “Lot D2, Watt Section”

- Source

Tom Taggart

- “In the process of registering [...] a small beef cattle farm”

- Source

New Brunswick

- Details: New Brunswick makes public disclosures for MLAs accessible online, with PDF reports available for each one. These reports were filed with the Legislative Assembly in 2023.

- Notes: Disclosures for five recently-elected MLAs (Mike Dawson, Susan Holt, Marco LeBlanc, Richard Losier, Réjean Savoie) in the New Brunswick legislature were not available at the time this data was captured. As a result, the number of total MLA disclosures reviewed was 44 instead of 49.

- Total MLAs: 12/44 = 27%

- Relative to per cent of MPs in New Brunswick invested in real estate: 27% (12/44) vs. 10% (1/10)

- Relative to per cent of MPs in New Brunswick invested in real estate: 27% (12/44) vs. 10% (1/10)

- MLAs by party

- PC: 8/29 = 28%

- Liberal: 2/16 = 13%

- Green: 2 / 3 = 67%

MLAs

Andrea Anderson-Mason

- “Vacant land, Shore Road, Breadalbane, N.B.”

- Source

Kevin Arseneau

- “Woodlot, Pleasant Ridge Road, Rogersville-West”

- Source

Kathy Bockus

- “Two-unit house” (spouse/common law)

- Source

Benoît Bourque

- “Condo, Ottawa (Riverdale Avenue)”

- “Duplex, Dieppe (Airview Street)”

- “Condo, Moncton (McAulay Drive)”

- “Co-owner of land Cocagne”

- “House, Dieppe (Albini Road)”

- “House, Moncton (Metcalf Street)”

- “House, Moncton (West Lane)”

- “House, Dieppe (Chartersville Road)(Champlain Street)”

- Source

David Coon

- “Woodlot in Grand Manan, NB” (Spouse/common law)

- Source

Jean-Claude D’Amours

- “44th Avenue, Edmundston, N.B.”

- “Canada Street, Edmundston, N.B.”

- “Trembles Boulevard, Gatineau, Quebec”

- Source

Bruce Fitch

- “One quarter interest in property situated at Blaine MacKeil, Caribou, N.S.”

- Source

Blaine Higgs

- “2 Vacant lots York County, N.B.”

- Source

Trevor Holder

- “2 vacant lots, Codys, Queens County, M.B.”

- Source

Margaret Johnson

- “Interval International Acadia Village Resort” (spouse/common law)

- Source

Mary Wilson

- “Beairsto Drive, Darnley, PEI”

- “Vacant lot Cricket Corner, Darnley, PEI”

- Source

Sherry Wilson

- “Burgess Transportation Services Inc.: Truck Terminal, Woodland”

- Source

PEI

- Details: Prince Edward Island makes public disclosures for MLAs accessible online, with PDF reports available for each one. The reports are accurate as of 2023.

- Total MLAs: 15/27 = 56%

- Relative to per cent of MPs in PEI invested in real estate: 56% (15/27) vs. 50% (2/4)

- Relative to per cent of MPs in PEI invested in real estate: 56% (15/27) vs. 50% (2/4)

- MLAs by party

- PC: 12/22 = 55%

- Liberal: 3/3 = 100%

MLAs

Gilles Arsenault

- “Vacant lots in Abrams Village”

- “Rental property located in Abrams Village: This property will be subject to a property management agreement.”

- “Income from rental properties in Abrams Village” (Spouse/common law)”

- Source

Robin Croucher

- “50% interest in a property in Souris, PID#648907‐000”

- “50% interest in a property in Souris, PID#648907‐000” (Spouse/common law)

- Source

Susie Dillon

- “Vacant land in Stanhope ‐ owned jointly with spouse”

- Source

Jamie Fox

- “Member holds 3 Class A Common Shares in J.D. Fox Enterprises Inc. and is the sole shareholder of the company.”

- “Income from the provision of guide services associated with rental of a private lodge in Green Mountain, NB” (J.D. Fox Enterprises Inc.)

- “6 acres of real property at Rayner Creek Road, PEI – PID#1065846” (J.D. Fox Enterprises Inc.)

- “Private lodge at Green Mountain, New Brunswick” (J.D. Fox Enterprises Inc.)

- Source

Robert Henderson

- “Income from rental of farmland”

- “The following parcels of land are owned jointly with his spouse (identified by Provincial Property Number): PID# 51672; PID# 51706; PID# 29561; PID# 1080183”

- Source

Ernie Hudson

- “Real property: 50% interest with spouse in 13158 Cascumpec Road, PID #55723 (subject to life interest reserved to Ted Hudson); 50% interest with spouse in 13160 Cascumpec Road, PID #678060; 50% interest with spouse in PID #793216 in Cascumpec”

- Source

Natalie Jameson

- “50% interest in vacant land in Greenwich PID# 1163989‐000” (spouse/common law)

- Source

Rob Lantz

- “Income from commissions as a real estate agent with Remax Charlottetown” (spouse/common law)

- “Coco Holdings Ltd.: Member has 49% of shares which are currently in a blind trust with Michael Fitzpatrick, Accountant; Spouse has remaining 51% of shares”

- “The company earns income from commissions on real estate sales.”

- Source

Matthew MacKay

- “Real property (PID 116326) in North Granville”

- “51% voting shares of 102995 PEI Inc”

- “Director of 102995 PEI Inc.”

- “102995 PEI Inc. – real estate brokerage”

- “Income from real property sales” (102995 PEI Inc.)

- “Real property located in Summerside” (102995 PEI Inc.)

- “Manages 3 summer rentals” (spouse/common law)

- “Income from 102995 PEI Inc.” (spouse/common law)

- “49% of shares in 102995 PEI Inc.” (spouse/common law)

- Source

Mark McLane

- “Income from rental properties”

- “Income from rental properties” (spouse/common law)

- “Rental property PID #1000769 – jointly with spouse” (spouse/common law)

- Source

Gordon McNeilly

- “Real property at 39 Dawson Court, Charlottetown, PE (PID# 694‐729‐000) – jointly with former spouse”

- Source

Hal Perry

- “Farmland in St. Felix – joint with spouse”

- Source

Barb Ramsay

- “In the past 12 months: Income from rental properties”

- Source

Bloyce Thompson

- “525 Class A Preferred Shares in Eastside Farm Inc., a private company: 50% of shares”

- “57 Class A Common Voting Shares in Eastside Farm Inc. a private company: 50% of shares”

- “525 Class A Preferred Shares in Eastside Farm Inc., a private company: 50% of shares” (spouse/common law)

- “57 Class A Common Voting Shares in Eastside Farm Inc. a private company: 50% of shares” (spouse/common law)

- “Eastside Farm Inc., Director” (spouse/common law)

- “Real property: 330 Frenchfort Road, Frenchfort, PEI: PID 142752; 401 Frenchfort Road, Frenchfort, PEI: PID 1076595” (Eastside Farm Inc.)

- Source

Bradley Trivers

- “Real property, Winsloe Road, PID 1096585‐owned jointly with Karen Trivers”

- Source